Early in my marketing career I read “Total Integrated Marketing”, a book that shaped my belief that high-growth firms are lead by teams who break the traditional silos holding client services, sales, marketing, and compliance.

This holds true in any industry, but especially so in financial services. The wealth management firms who are growing rapidly today have leadership teams that take advantage of a growth mindset to earn the right to connect and serve investors of all ages. With approximately $2 billion in assets moving from Baby Boomers to Gen X and Gen Y investors each day, there is a massive opportunity to drive AUM growth in today's market1.

The 5 Traits of Growth Minded Wealth Management firms are a...

- Commitment to client segmentation

- Willingness to experiment

- Desire to engage investors with next-gen marketing strategies

- Focus on growth-oriented investments

- Revenue-oriented Key Performance Indicator model

Let's take a closer look at each of these five key traits.

1) Commitment to client segmentation

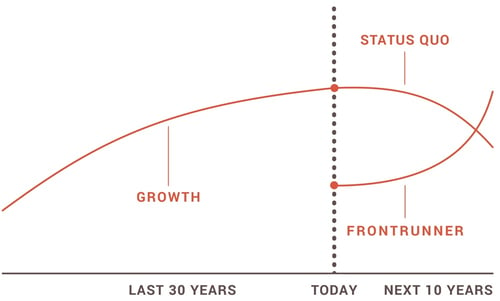

Over the past several years, we’ve seen more and more firms spend time on client segmentation. Client segmentation helps firms to improve their service model, by enabling firms to better support specific segments of their current client base. Likewise, firms are then able to leverage this data to inform their marketing efforts by defining and targeting specific investor personas who look like their best, current clients. The firms who are poised for the greatest growth over the next decade are those firms who have defined the next-generation of investors and are building service models to attract and service them.

2) Willingness to experiment

While not popular to many, innovative or "frontrunner" firms know the importance of leveraging the scientific process to build their marketing strategy. While there are best practices to inform decisions, you will need to take an experimentation mindset to discover the exact formula that works best for your firm’s growth. In a recent podcast, “Experimentation = Success”, I talked about the importance of this experimentation mindset and how high-growth wealth managers are using it to expand their marketing and reach more, better qualified investors.

3) Desire to engage investors with next-gen marketing strategies

We are in the midst of the largest wealth transfer in modern history, as $30 trillion dollars will move from Baby Boomers to Generation X and Y investors over the next 40 years1. This means that every single day, $2 billion dollars in assets is moving from one generation to the next through a death in the family, estate liquidation, or early inheritance.

Most critically, we also know that 66% of children will fire their parent’s financial advisor after receiving an inheritance2. If $2 billion is moving every day, and 66% of children are leaving their parents financial firms, this means there are $1.32 billion in assets which are effectively “up for grabs” on a daily basis. To put this in a little bit more context: just in the time you have been reading this blog post, $4.5 million in assets have left an established financial relationship.

While this fund movement represents a massive business risk for financial brands across the spectrum, it represents an even larger opportunity for firms which are actively engaging the next generation of investment clients. This engagement can require firms to take a fundamentally different approach to marketing than what has been successful with the baby boomers who have historically driven AUM growth.

The most successful firms are acutely aware that how they would like to market themselves may be very different than how Gen X and Gen Y investors would like to receive information.

4) Focus on growth-oriented investments

According to the 2017 RIA Benchmarking Study from Charles Schwab, the top 20% of RIAs in terms of growth saw an average 5-year net organic CAGR of 9.4%, with 38% of this growth attributed to marketing activities3. The bottom 80% of RIAs in terms of growth saw an average 5-year net organic CAGR of just 3.9%, with 31% of this growth attributed to marketing activities.

While correlation is not causation, this data shows that high-growth firms are capturing more assets, as a percentage of overall growth, through marketing activities when compared to their low-growth peers. The referral channel—both from existing clients and centers of influence— accounted for the remaining two-thirds of firm growth over this time period.

According to a separate study by Pershing, the average firm is plowing back just 1.80% of revenue into marketing4. With this investment, comes a distinct line in the sand between high-visibility and low-visibility independent financial brands. While we certainly do encounter success stories from firms investing less than 1.00% of revenue in marketing, the data supports the idea that client acquisition and marketing investment are related - as we would expect in any industry.

5) Revenue-oriented KPI model

The final trait, and quite possibly the most important, is how the best firms are tracking and measuring growth using revenue goals verse monthly lead quantity metrics. By shifting to a revenue-oriented mindset, high growth firms are able to focus on building highly-targeted campaigns that are designed to attract their specific investor persona. The more affluent the firm’s investor persona, the more important this approach becomes.

If a $1B firm wants to grow at 5% they will need to add $50M in new client assets. If their average client size is $2M and their close ratio is 50% they will need to generate $100M in pipeline value to hit their goal.

This translates to 50 qualified leads and 25 new clients a year.

Use the fields below to schedule a short 15-minute call to discuss your firm's growth targets and we are helping independent financial brands reach theirs.

- InvestmentNews, The Great Wealth Transfer is Coming, Putting Advisors at Risk

- Accenture, Capitalizing on the Intergenerational Shift in Wealth

- Charles Schwab, 2017 RIA Benchmark Report

- Pershing, 2016 Financial Performance Study

Photo by paul mocan on Unsplash

Craig Hall is founder and president of Marketing Wiz, a financial marketing firm specializing in the independent wealth management space.