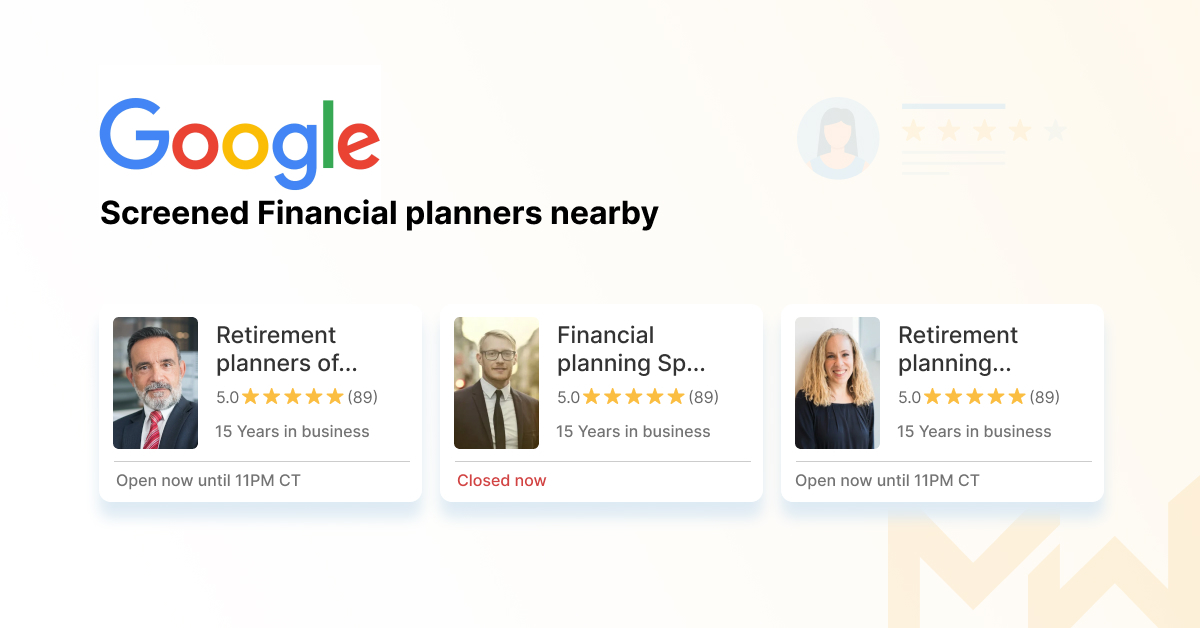

As an RIA, reputation is everything. And as people increasingly navigate their financial lives digitally, maintaining a professional online presence is an important component of reputation management. One good way to make sure that your digital profile is complete is with the Google Screened program.

Google Screened verifies key information about your firm to verify that you are a legitimate business. For RIAs and financial planners, a background, insurance, and license check are all required.

Google Screened also gives RIAs a chance to compete for high-value search terms associated with the financial industry. While it’s difficult to compete directly with large institutions in the SEO domain, RIAs may be able to use Google Screened to stand out in local search results for valuable keywords, such as “financial planning,” “wealth management,” and “tax planning.”

In this article, we’ll discuss how Google Screened works and why it’s a valuable asset for RIAs to include in their digital profile.

Why Get Google Screened?

After you go through the Google Screened process, a green checkmark will appear by your firm name when your business appears in search results.

If a client is referred to your firm by word of mouth, they will likely do some extra research online to find out more information about your team. In addition to traditional regulatory vetting through FINRA and the SEC, Google Screened serves as one more way to show clients that your firm is legitimate. Moreover, having a complete digital profile appears more professional than an incomplete online presence.

Going through the process may also help you rank higher for geographic search phrases, such as “financial advisor near me.” This is an effective way to make sure prospective clients are seeing your firm ahead of most competitors. Moreover, if you decide you want to run Google Local Services ads, being Google Screened is a requirement.

Google Screened also serves as a way to effectively compete for high-value search keywords. Large financial institutions spend millions of dollars to appear in the top results when people use Google to search for phrases like “financial planning,” “wealth management,” and “tax planning.” For RIAs, competing directly for this traffic is not cost-effective. What RIAs can do, though, is compete for geographically targeted search terms that use these high-value keywords.

Finally, getting Screened helps people know that they are contacting the real you. The green checkmark lets potential clients know that your firm’s address and phone number have been verified. This is an efficient way to boost cybersecurity efforts and protect clients from potential scams.

How to Get Google Screened

Getting Google Screened won’t cost you anything, although getting through all the steps will take a bit of time and diligence and may challenge your policy regarding requests for client feedback and testimonials as outlined in the SEC’s new marketing rules. Due to the testimonial aspects that are involved, your firm will likely need an internal compliance framework for this initiative.

Step 1: Sign up for a Google Business Profile if you don’t have one already. This is the first step to having a business presence with Google and will allow you to respond to Google reviews. This process will confirm information like your address, website, and more.

Step 2: Apply for a Google Local Services Ad account. Even if you don’t plan to run local ads, Google Screened is managed through this account, so this step is required. Google has a dedicated team to support this process should you run into trouble.

Step 3: Ensure you have at least a 3-star rating or higher on your Google reviews. This is a requirement to become Google Screened. This requirement may be a challenge for RIAs, many of which do not currently have a rating on Google. As it stands, the RIA industry is in a transition period when it comes to requesting client reviews and feedback. While recently revised marketing rules have expanded firms’ ability to do so, some may feel that the compliance risks are not worth it. Therefore, the 3-star requirement could be a barrier to Google Screened implementation for certain RIAs.

Regardless of how you choose to handle your online reputation, it’s highly recommended to implement a reputation management system so you can monitor what’s being said about you online. Clients and prospects can leave reviews for your firm whether you ask them to or not, and Google may not be willing to intervene on challenging reviews.

Step 4: Provide licensing and insurance information for your RIA. You will need to provide appropriate insurance information showing general liability insurance and detail the licenses of all applicable employees at the firm.

Step 5: Await background check completion. The firm owner, the firm itself, and licensed professionals at the firm will all need to have a background check completed. As you might guess, completing this step can take some time as you await the conclusion of the background checks.

Step 6: Complete the Screening Process. Once all the preceding steps are complete, you should be all set up with a green checkmark indicating that you are Google Screened. This status can be maintained by keeping all business information up to date.

Conclusion

Completing the Google Screened process is one way to bolster your firm’s online reputation and digital profile. The program is free and, in coordination with traditional regulatory screening, can help clients trust that your firm has been vetted. Google Screened can also serve as a valuable tool to compete for high-value SEO keywords and improve cybersecurity efforts.

If you're interested in implementing Google Screened for your firm, don't hesitate to connect with the team at Marketiz Wiz. We look forward to providing thoughtful guidance on the best path forward that complements your existing digital strategy.