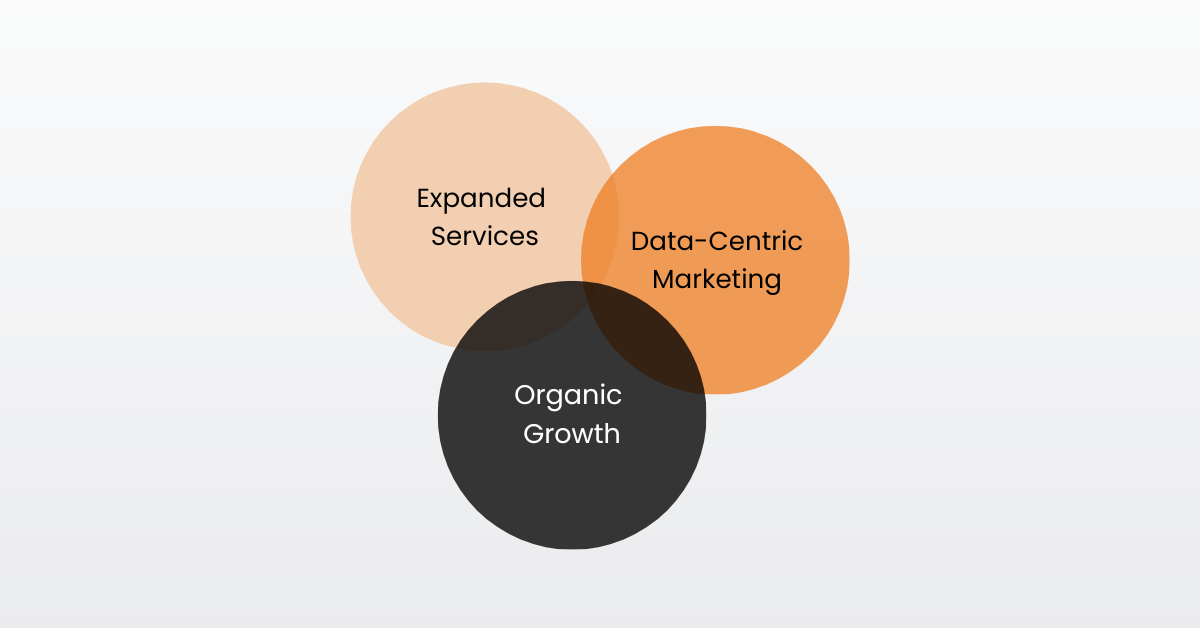

In the evolving landscape of wealth management, Registered Investment Advisors (RIAs) are undergoing a significant transformation, transcending the traditional pillars of investment management and financial planning. This shift, as highlighted in the 2023 Fidelity RIA Benchmark Study, is not merely a change in services offered but a fundamental reimagining of the role of wealth managers.

Back in 2017, Fidelity introduced the Advice Value Stack, a concept designed to help wealth management firms maximize the value they deliver to clients. This model articulates how investors assign value in the advice relationship, starting from the foundational management of money to guiding clients toward achieving goals, peace of mind, and, ultimately, fulfillment.1

This evolution is marked by a broadening of service offerings, essential for addressing the complex financial and personal needs of high-net-worth and ultra-high-net-worth individuals. The integration of a comprehensive suite of services ranging from more traditional line items like estate planning to bookkeeping and venturing into newer service lines — things like concierge health services — reflects the fact that financial well-being is intrinsically linked to overall life satisfaction.

Moreover, the strategic use of data-centric marketing and client segmentation allows firms to better understand their clients and prospects, enabling them to tailor their services and communications. This comprehensive approach leverages marketing automation, sales collateral, and educational materials, feeding valuable insights back into the CRM system. This not only enhances the advisor-client relationship but also moves the value of the advisory relationship from mere returns on investment to helping clients plan for life, achieve peace of mind, and ultimately reach a state of fulfillment.

Expanding the Service Horizon

The evolution of RIA firms is characterized by embracing a more holistic suite of services that have typically only been offered through multi-family offices. This expansion includes Estate Planning and Wealth Transfer, Cash, Debt and Expense Management, Philanthropic Strategy, Family Legacy and Governance, Insurance Consultation, Tax Planning, Bookkeeping and Bill Pay, and Concierge Health Services. As highlighted in the 2023 Fidelity RIA Benchmark Study2, such diversified service offerings are instrumental in driving organic growth, emphasizing the necessity for a comprehensive wealth management approach.

Estate Planning and Wealth Transfer: Ensuring efficient wealth transition to future generations while addressing legal complexities and family dynamics.Concierge Health Services: Providing personalized healthcare management and advisory services, focusing on preventive care and wellness strategies to support the overall health and well-being of clients.

Cash, Debt, and Expense Management: Managing cash flow effectively, optimizing debt structures, and overseeing expenses to maintain financial health.

Philanthropic Strategy: Aligning charitable giving with personal values and legacy aspirations, creating impactful philanthropic plans.

Family Legacy and Governance: Establishing frameworks for family governance, fostering a sense of shared purpose and continuity across generations.

Insurance Consultation: Evaluating and advising on insurance options to protect assets and manage risks.

Tax Planning: Strategizing to minimize tax liabilities while complying with regulations, ensuring efficient wealth accumulation and transfer.

Bookkeeping and Bill Pay: Streamlining financial administration, ensuring accuracy and efficiency in managing day-to-day financial transactions.

Tailored Solutions for Complex Financial Landscapes

Affluent clients often encounter unique financial challenges that necessitate sophisticated, personalized solutions. Comprehensive wealth management now encompasses a range of services, each tailored to address specific aspects of a client's financial and personal life. From ensuring efficient wealth transition and managing cash flow to aligning charitable giving with personal values and establishing family governance structures, these services are designed to provide a holistic approach to wealth management.

Integrating the Advice Value Stack into the RIA Service Model Philosophy

To effectively serve affluent clients, RIAs must offer tailored solutions that address each client's unique challenges and opportunities. This personalized approach is key to ascending the Advice Value Stack, which includes:

Investment Management as the Foundation: The core of financial advisory services, evolving to add more value beyond basic expectations.

Financial Planning – The Next Step: Developing a detailed financial roadmap that encompasses all aspects of a client's financial journey.

Peace of Mind through Comprehensive Services: Expanding services to address broader aspects of a client's financial life, ensuring harmony towards their goals.

Fulfillment – The Ultimate Goal: Assisting clients in achieving fulfillment by understanding their life's purpose, legacy, and aspirations while aligning their financial strategy with these objectives.

Crafting a Holistic Wealth Management Service Offering

The path to sustainable organic growth for RIA firms lies in embracing the full spectrum of the Advice Value Stack. By evolving from traditional investment management to a more comprehensive suite of services, RIA firms are well-positioned to meet the complex needs of their clients comprehensively. This approach not only drives organic growth but also fosters deeper, more meaningful relationships with clients, ultimately leading to mutual success and fulfillment. The strategic blend of a wide array of service offerings and data-centric marketing is key to crafting a holistic wealth management service offering in today's competitive financial landscape.

Contact us to learn how we can help you package and articulate your services, and communicate your firm’s value to clients and prospects.

1Fidelity Investments. (2023). 5 Steps to Stand Out in Every Environment: A Guide to Help Advisors Build a Holistic, Relationship-Based Business to Deliver Across All Levels of the Advice Value Stack®. Retrieved November 27, 2023, from https://institutional.fidelity.com/app/literature/white-paper/9909384/5-steps-to-stand-out-in-every-environment.html.

2Fidelity Investments. (2023). Fidelity Investments RIA Benchmarking Study. Retrieved November 27, 2023, from https://clearingcustody.fidelity.com/app/proxy/content?literatureURL=/9907134.PDF

Craig Hall is founder and president of Marketing Wiz, a financial marketing firm specializing in the independent wealth management space.